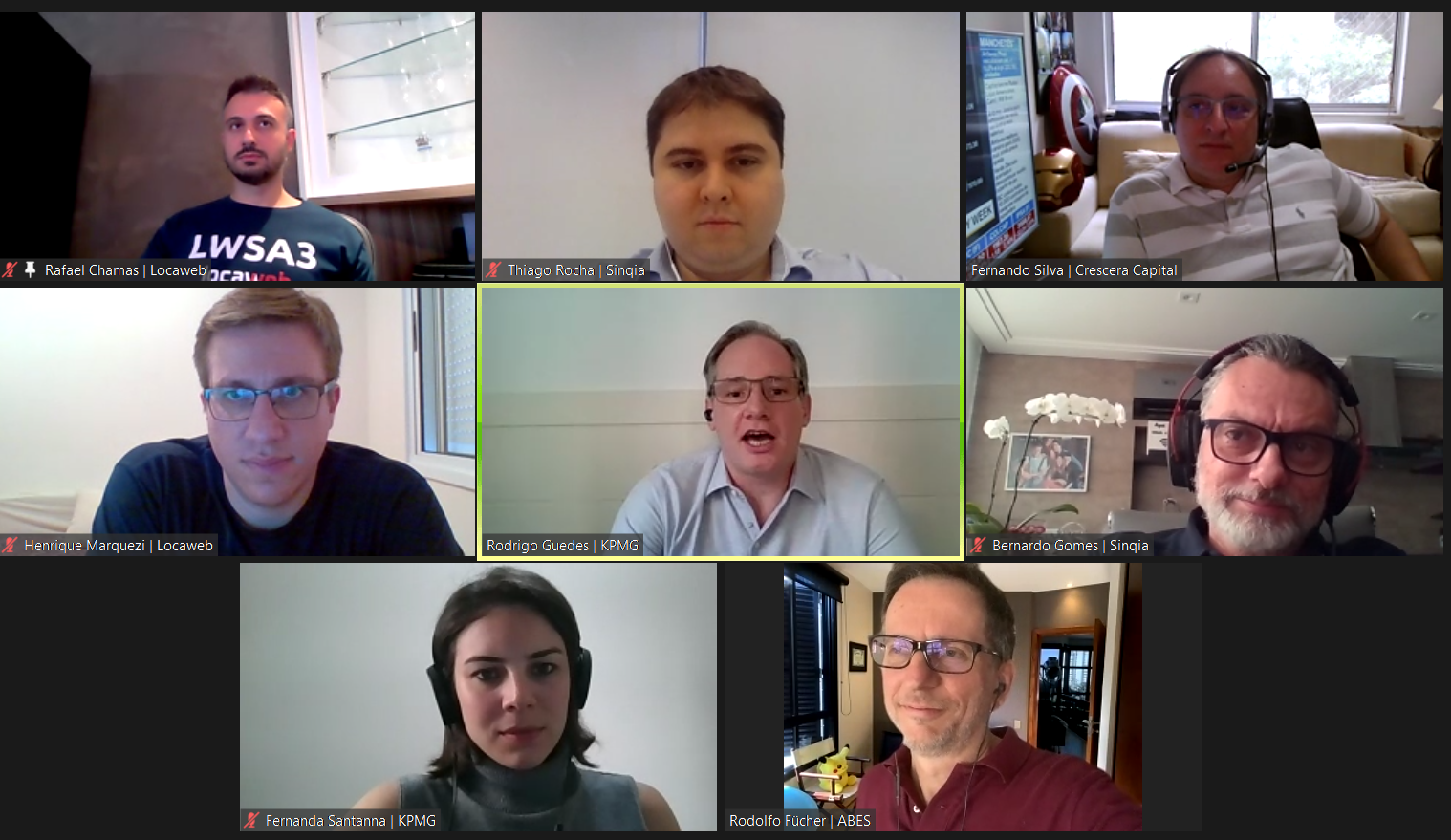

ABES and KPMG promoted the webinar New Times: IPO Processes and Experience of Companies and Funds, on October 7, 2020. The objective was to discuss how companies should prepare for a public offering of shares, which involves a strategic plan for going public, a governance policy and changes in the company's management.

After the opening by ABES president Rodolfo Fücher, the presentation was conducted by Rodrigo Guedes, Head of Equity Capital Markets Advisory - Deal Advisory & Strategy at KPMG in Brazil, who gave an overview of the changes in the Brazilian capital market due to the fall in the Selic Rate, with the migration of money from fixed income to the stock exchange, which contributed to the recovery of the Ibovespa indexes. “Until September, companies in Brazil raised R$ 22 billion in IPOs, resources that will be used to make business plans viable. More R$ 56 billion were raised in follow-on operations in 2020 ”, he explained.

Fernanda Santanna, Corporate Governance Manager at KPMG, commented that companies do not yet have the dimension of governance requirements for an IPO, and it is important that they know the Brazilian and international regulatory framework. “Transparency is required in the governance practices of companies listed in category A of the stock exchange. If a company does not practice what is recommended in the code, it has to justify the reason to the market and inform if it intends to comply in the future and what mitigation actions are foreseen ”, he said.

Thiago Rocha, CFO of Sinqia, said that the company is the main supplier of software for the financial market, recorded 15 consecutive years of growth and 88% of recurring revenues. Founded in 1996, the company's equity history records 3 cycles, starting with an investment in 2005 of R$ 7 million by Stratus and BNDESPAR until the capture, in 2019, of R$ 362 million in a follow on. The contributions have contributed to Sinqia acquiring other companies and the company's growth has generated value and liquidity for shareholders.

Rafael Chama, Locaweb's CFO / IRO, spoke about the company's recent IPO in 2020, a fundraising that should contribute to the acquisition process. “Locaweb is a highly cash-generating company. We have grown so far with our own resources. We are a company focused on SMEs. There are more than 370 thousand customers, today, at the base, with almost 100% of recurring revenue ”, he explained.

Also present at the webinar was Fernando Silva, partner and Head of Venture Capital at Crescera Capital (Bozano Investimentos, until December 2018) and who currently has privileged investments in private equity and venture capital, with investments in businesses in the areas of health, education, consumer goods, services and information technology. “We like to select companies from the middle market and who are not so much on the radar to turn them into market leaders. Our investment project is always very constructive ”, he explained.

To watch the webinar in full, visit: https://www.youtube.com/watch?v=DSUImsofGlg&list=PL2X1JJqBpAkOvAJ7KS25L7wFzIUUQHMih